Sections

Highlight

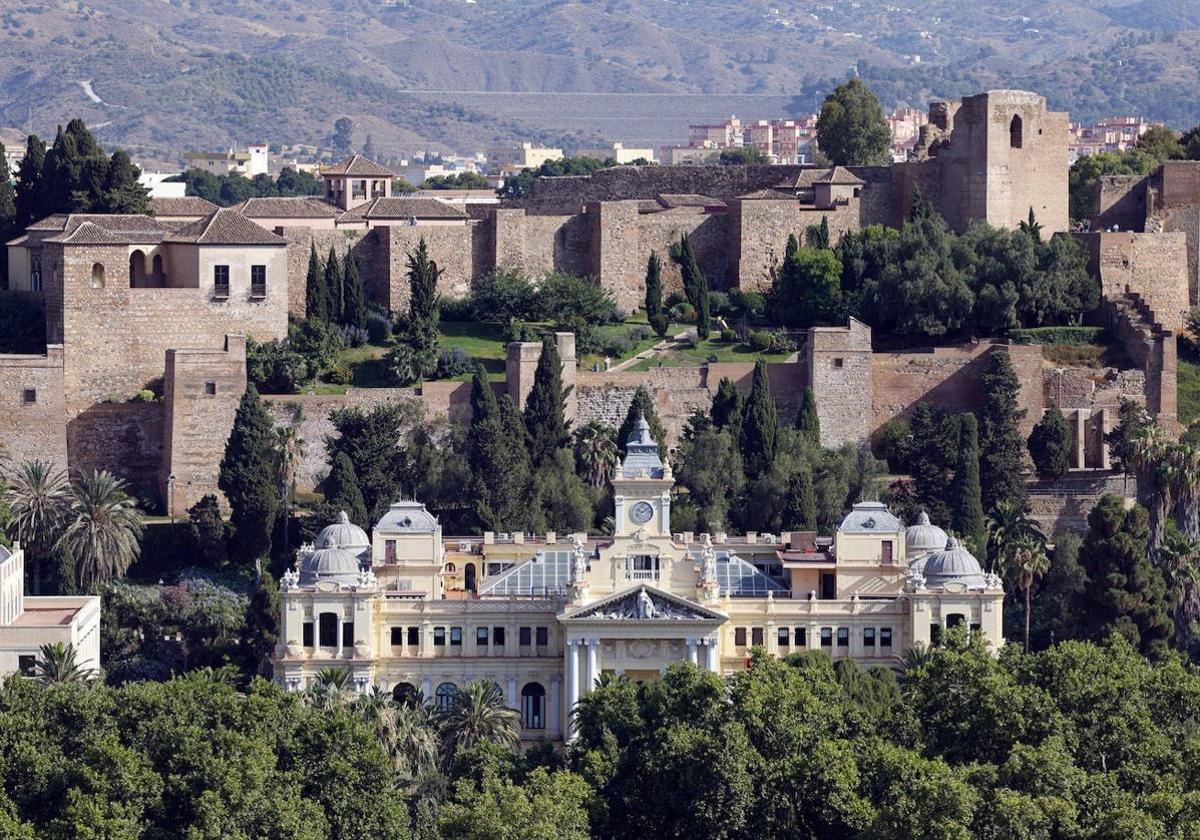

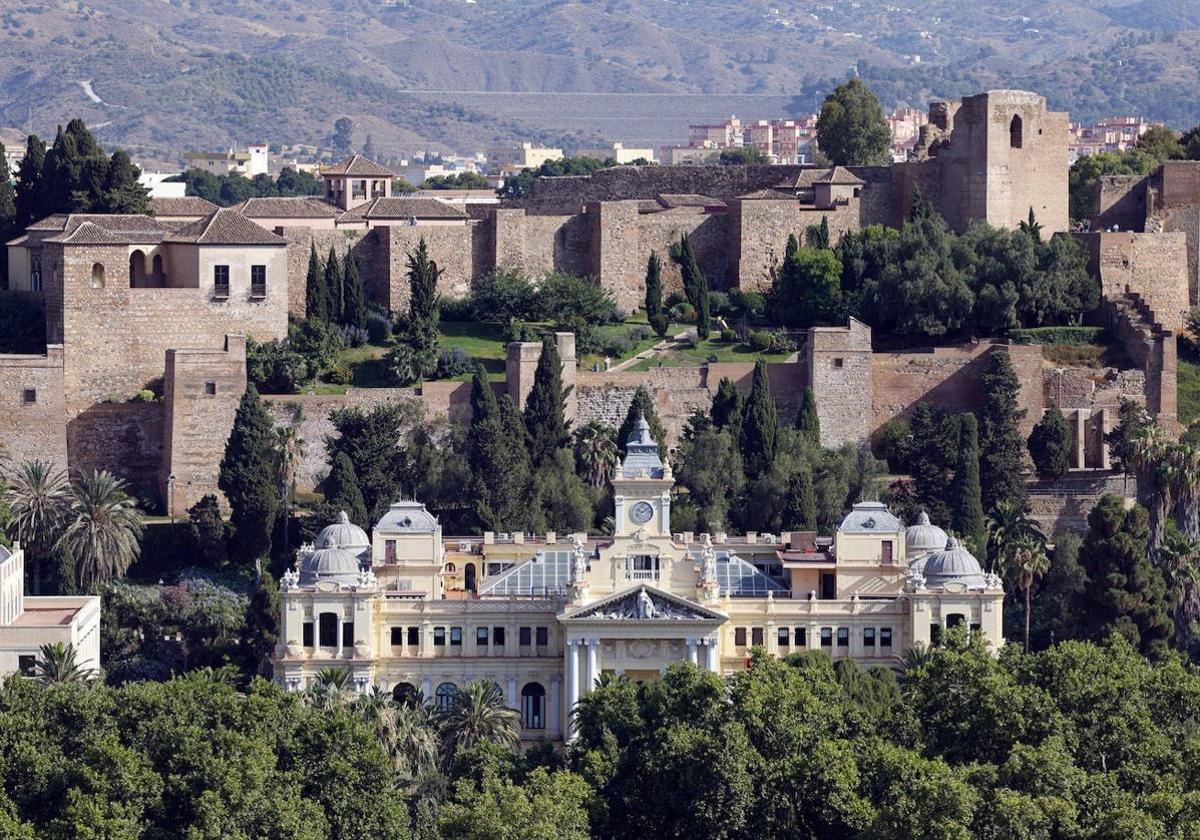

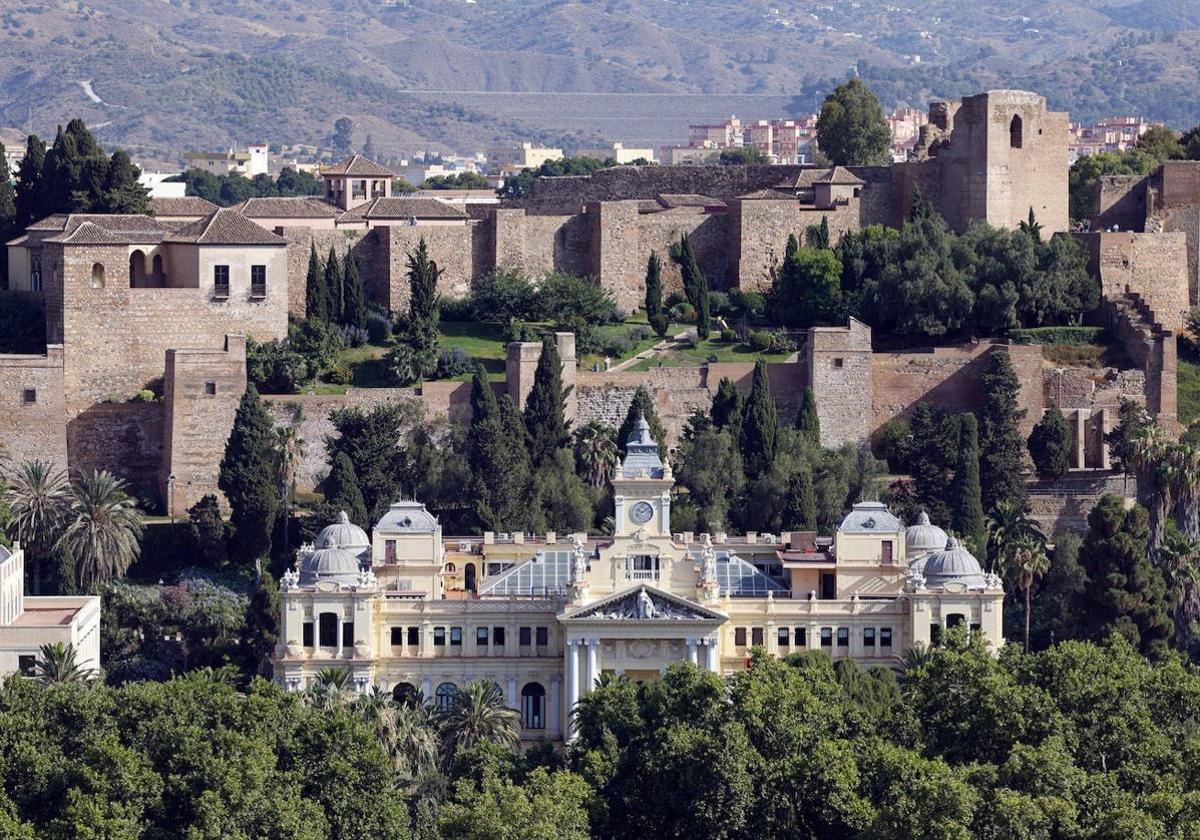

How much tax do the local councils in Malaga province collect? One of the ways to measure this, especially to find out the impact of local tax policy on each citizen or resident, is to calculate the average municipal tax revenue paid per inhabitant. This is one of the data analyses done by Andalucía's IECA institute of statistics and cartography using data from the nationalMinistry of Finance in Madrid.

Although there are around a dozen localities in Malaga province for which no data is available, of the total of 92 municipalities for which details are available the first noteworthy figure to be extracted is that these councils receive an average of 640 euros per capita strictly in taxes and fees (one must add what is paid by the public and what is received in transfers from other governing bodies to calculate total municipal income, as will be seen).

Despite this healthy average, the range of deviation from that is enormous. For example, Benahavís town hall is the one to receive the most money per inhabitant in the whole of Malaga province - nearly 3,000 euros (2,897.50 euros, to be precise) in 2023, the last year for which information is available. A long way behind that figure is the town in second place, Casares, collecting almost 2,050 euros per head.

At the opposite end of the scale are Júzcar and Algatocín, with around 300 euros per capita. Meanwhile, Malaga city is closer to the bottom of the list than the top in terms of tax revenue per capita, standing at 580 euros, an amount that is also slightly below the provincial average.

These revenue figures correspond to the taxes that all local councils in Spain are obliged to collect in accordance with the law regulating local finances. They consist of the property tax (IBI), the tax on economic activities (IAE, for businesses) and road vehicle tax (IVTM). These are tax figures to which, if that is the will of those in charge of local government (all too often the case, especially in the larger municipalities), can be added a requirement to pay other optional taxes. These optional taxes are the tax on any increase in urban land values (like a municipal capital gains tax) and the tax on building work. The third element to municipal income is the proportion of state taxes paid to local councils, especially from IVA (sales tax on goods and services) and personal income tax (IRPF), although these barely account for 5% of the tax revenue of local councils in Malaga province as a whole.

Among the municipalities with the highest tax revenue per inhabitant, apart from Benahavís and Casares, the variety is considerable with Viñuela in third place at around 1,900 euros per capita, then in fourth place is Marbella with 1,640 euros. Other towns collecting over 1,000 euros per inhabitant in these taxes are Teba, Estepona, Manilva, Torremolinos and Nerja.

The fact that per capita tax revenues are higher in these municipalities is not exclusively, nor necessarily, related to the fact that taxes are higher in these locations. For example, IBI, the most significant of all municipal taxes, is influenced by the way in which each council has designed it and also by the volume and value of the property stock in that particular municipality, as well as the number of inhabitants by which the revenue is divided to obtain the per capita figure.

A few examples may serve to clarify this situation. The average property tax (IBI) paid in Benahavís is limited to 341 euros, compared to the average of 640 euros paid in Torremolinos, according to data calculated by SUR in a report published last July. The difference is that in Benahavís around 16,000 IBI bills are issued for a total of 9,244 inhabitants, whereas in Torremolinos there are 73,000 properties that are subject to this tax with a total of 70,400 residents.

Let's take another couple of examples: in Casares the per capita tax revenue is around 2,050 euros, a figure that contrasts with that of Marbella at 1,640 euros. In the first case, the town's 13,166 IBI bills are levied at an average of 521 euros, which have to be divided between just over 8,100 residents. Meanwhile, in Marbella there are 176,444 IBI bills charged at an average of 556 euros for 156,300 inhabitants. In Estepona, where the per capita tax income is 1,160 euros, there are 83,319 tax bills paid at an average of 566 euros per capita for around 77,000 residents.

Something more striking happens in certain cases with road tax (IVTM). This is a devilishly complex tax because the bill varies not only according to the type of vehicle (car, motorbike, van, lorry or trailer), but also according to its characteristics in terms of cylinder capacity, seating capacity or the volume of load it can hold. Some cases really stand out if one contrasts the number of bills issued (in terms of the number of vehicles) with the number of residents. For instance, in the village of Montejaque there are 20,655 vehicles for less than 1,000 inhabitants and in Macharaviaya there are over 7,500 vehicles for 523 residents. Interestingly, these are two of the municipalities for which IECA has no information on income per inhabitant. In contrast, in Malaga city the number of vehicles is around 430,700 for its nearly 590,000 inhabitants, while in Marbella there are just over 113,500 vehicles for over 156,000 residents.

As far as the business tax (IAE) is concerned, the coefficients applied by the local councils vary and, given that it is a tax on business activities on companies with a turnover of over one million euros, the volume of companies and their size has an impact on its collection. In the province of Malaga the number of companies registered with Social Security by municipality ranges from around 19,600 in Malaga city and over 8,200 in Marbella to barely half a dozen companies in villages such as Atajate and Igualeja.

César García Novoa, a taxation law professor at the University of Santiago de Compostela, says that local taxes are closely linked to the size of the population and much less to their level of income. This explains why the capital of the province, the most populated city, is the municipality with the highest total tax revenue of 340 million euros, followed by Marbella, the second most populated city, with 256 million euros. Still, Estepona collects 89.2 million euros in tax revenue, outstripping other more populated municipalities such as Mijas (85.3 million euros), Fuengirola (72.65 millions) and Velez-Malaga (66.2 millions).

It is worth noting that the resources available to local councils do not only come from taxes. The law governing local finances gives them the power to establish prices for the provision of public services or the performance of administrative activities. In addition, local revenues include transfers from other governing bodies, among other important items.

The municipalities where the local budget depends most on taxes are Benahavís (80%) as well as Marbella and Casares (76%), while in Mijas, Viñuela and Manilva tax revenues exceed 70% of total income at the disposal of the municipalities.

Turning to villages like Júzcar and Benarrabá in the Serranía de Ronda, taxes account for less than 5% of total income, and in Atajate, Faraján and Parauta they do not even reach 10%. The latter are some of the least populated municipalities in the province. In none of them does the number of residents reach 500. Moreover, some of these top the ranking of income per inhabitant (this means the income total, which includes taxes and fees, public charges, fines, penalties as well as subsidies and donations). This is because not all payments are made by its inhabitants, there are also transfers from other governing bodies - state, regional and provincial. Total income per capita for Benarrabá and Atajate amount to 7,000 euros each, in Júzcar it is over 6,200 euros, while in other municipalities with very few inhabitants such as Benadalid, Cartajima and Faraján, they range between 4,000 and 5,000 euros per capita.

García Novoa explains why this happens: as local taxes are closely linked to population, the most self-sufficient municipalities - those that depend less on funds from other authorities and more on contributions from their residents - are those with the largest populations. Jorge Onrubia, professor of public finance at the Complutense University of Madrid, adds that the largest municipalities are those that can have more revenue from IBI because they have more properties of higher value, large companies being charged IAE and capital gains tax on property sales and purchases, as well as more garages for which they can charge for parking. The smaller municipalities live more on the solidarity of the state system.

More information can be gleaned from IECA's figures as to which municipalities spend the most per capita. Those at the top of the ranking are, once again, villages with small populations such as Atajate (7,644.82 euros per capita), followed by Benadalid (4,508 euros), as well as Parauta, Faraján and Júzcar (around 3,500 euros per capita).

Among the most populated municipalities, the one with the highest expenditure per inhabitant is Marbella, with 2,100 euros. It is followed by Nerja (1,735 euros) and Torremolinos (1,692 euros), while Vélez-Málaga, Estepona and Fuengirola are around 1,450 euros per capita, with Malaga city also close to that figure.

The last question to be answered by these statistics is which municipalities have the highest surplus and deficit per inhabitant - which earns more than they spend or which spends more than they earn per capita. Among the former are Benarrabá (4,394 euros), Júzcar (2,809 euros), Benahavís (1,353 euros). Among the latter to stand out are Villanueva del Rosario (-1,014 euros), Cuevas Bajas (-819 euros) and Istán (-530 euros) stand out.

In the large municipalities like Malaga, Marbella, Mijas, Torremolinos and Antequera, income and expenditure per capita are practically equal. Meanwhile, in Fuengirola and Vélez-Málaga there is a slight deficit, as in Ronda.

Publicidad

Publicidad

Publicidad

Publicidad

Esta funcionalidad es exclusiva para registrados.

Reporta un error en esta noticia

Debido a un error no hemos podido dar de alta tu suscripción.

Por favor, ponte en contacto con Atención al Cliente.

¡Bienvenido a SURINENGLISH!

Tu suscripción con Google se ha realizado correctamente, pero ya tenías otra suscripción activa en SURINENGLISH.

Déjanos tus datos y nos pondremos en contacto contigo para analizar tu caso

¡Tu suscripción con Google se ha realizado correctamente!

La compra se ha asociado al siguiente email

Comentar es una ventaja exclusiva para registrados

¿Ya eres registrado?

Inicia sesiónNecesitas ser suscriptor para poder votar.